RI's Knowledge centre

Keeping up to date is important, so here's the news.

Here is a scenario that plays out far more often than most people realise. A man remarries after a divorce.

At some point, most Australian families confront one of retirement’s most complex financial decisions: how to fund residential aged care.

Dementia feels very different up close than it does in abstract statistics or policy papers.

For many Australians, the housing market does not just feel expensive – it feels frag‑ ile.

Many Australian parents are on track to leave far more to their children than they themselves received, as an estimated A$5.4 trillion of wealth passes between generations over coming decades.

At the age of 95, Warren Buffett stands as an unmatched figure in the world of invest- ment—a “flawed genius” whose wisdom, resilience, and humility continue to shape financial strategies and client outcomes well beyond his formal retirement.

The Australian commercial property market is experiencing a pivotal moment, propelled by shifting macroeconomic conditions and an influx of institutional and retail investor confidence.

Every year, thousands of Australians nearing or in retirement confront the same frustrating bureaucracy: a complex and often confusing patchwork of federal and state concession schemes designed to ease the cost of living—but difficult to find, claim, or renew.

The Australian Government’s Home Guarantee Scheme has undergone a significant transformation with major policy reforms introduced from 1 October 2025.

For many Australians, the vision of retirement conjures up images of relaxation, freedom, and well-earned peace of mind.

Periods of sustained market decline, such as multi-year bear markets, are rare but influential events in the financial lives of investors.

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” These words, often attributed to Einstein, echo across generations for a reason.

When life throws you a curveball—a broken-down car, an unexpected medical bill, or simply the temptation of a flash sale—how do you respond?

Imagine being faced with a simple choice: you can have $100 today or $120 if you’re willing to wait a year. The rational response may seem obvious—wait for the higher payout.

Philanthropy in Australia is changing. It’s no longer just for the wealthy or for big corporations - everyday Australians are discovering how giving can be both deeply rewarding and financially smart.

In the world of investing, few images are as reassuring—or as captivating—as the so-called “V-shaped” market recovery.

When it comes to preparing for retirement, many Australians focus on growing their superannuation individually.

Wealth, Wisdom, and Wellbeing: How End-of-Year Super Planning Can Secure Your Future

Australia stands at a pivotal demographic juncture. As the government incrementally raised the Age Pension eligibility age from 65 to 67-a transition completed in July 2023- there is growing debate about the broader social consequences of such reforms.

Introduction: The Rise of Family Trusts and the Challenge of Relationship Breakdowns

Market volatility is an inevitable part of investing, yet it often evokes fear and uncertainty among investors. The phrase “catching a falling knife” vividly captures the dangers of trying to time the market during sharp declines—it suggests that attempting to buy assets during a precipitous drop can lead to painful losses.

Australia finds itself at a critical juncture. The nation’s economy, while resilient in many respects, faces mounting pressures from stagnant real income growth, rising costs of living, and declining productivity.

In the unpredictable world of investing, where the promise of high returns often dazzles, a quieter principle shines through the "silver rule" of investing.

After a brief downswing, national average property prices hooked back up in February, reflecting the anticipation and then reality of the RBA starting to cut rates.

In the realm of investment strategies, dividend investing has long held a special place in the hearts of Australian investors.

In the ever-changing landscape of financial markets, few voices carry as much weight as Warren Buffett’s.

“The Richest Man in Babylon” by George S. Clason is a classic personal finance book that was first published in 1926. It is a collection of parables set in ancient Babylon, which teach simple yet powerful financial lessons that are still relevant today.

Clearly residential real estate has defied the many doomsday forecasts made over the last few years, having moved through the bottom of its cyclical downturn in early 2023 and experiencing an overall strong recovery since.

Australia’s cities have long been viewed as engines of economic growth and opportunity, drawing people from across the nation and around the world with the promise of higher wages and enhanced career prospects.

Australia’s housing market has long been a cornerstone of wealth generation, yet its increasing inaccessibility poses significant challenges to financial stability and retirement planning.

Beneficiary nominations are a vital aspect of superannuation that often go overlooked.

In today’s volatile financial landscape, navigating market fluctuations and securing wealth for future generations requires more than just strategic investments.

“Common Stocks and Uncommon Profits” is a seminal work on investing by Philip A. Fisher, first published in 1958. This influential book outlines Fisher’s investment philosophy, which focuses on identifying and investing in high-quality growth companies for the long term.

“The Psychology of Money” by Morgan Housel is a captivating exploration of how our minds shape our financial decisions. This insightful book delves into the com- plex relationship between human behaviour and money management, offering a fresh perspective on personal finance that goes beyond traditional advice.

Estate planning is a crucial aspect of financial management that extends far beyond simply writing a will. It encompasses a range of strategies and legal arrangements designed to manage and distribute your assets after your death, as well as to plan for potential incapacity during your lifetime.

The world has undergone a transition in its financial climate, moving from low-rate, stable inflation conditions to a period of higher rates, a spiralling cost of living and rising uncertainty across financial markets.

The Encyclopaedia Britannica website explains that life expectancy is “an estimate of the average number of additional years that a person of a given age can expect to live.” The key word here is average, and there are different ways of calculating it.

The superannuation guarantee (SG) payment for PAYG employees increased by half a percentage point to 11.5% on July 1, 2024. This means employers are now required to con- tribute a higher percentage of an employee’s salary to their superannuation fund, boosting retirement savings for workers across Australia.

Changes in the value of the Australian dollar are important as they impact Australia’s international export competitiveness and the cost of imports, including that of going on an overseas holiday.

As medical advancements and improved living conditions continue to extend human lifespans, the traditional concept of retirement is undergoing a significant transformation.

Today’s story looks at two key factors that determine the answers to the big questions when planning retirement finances: ‘How much do I need?’, and ‘How much can I afford to spend?’ - in order to have confidence that you can maintain your living standards, not run out of money, and not have to rely on welfare.

The demographics of how long we will live reveal some surprising statistics, especially in Australia. We frequently hear about people living into their nineties, and even one hundred years or more, but we read less about the other side of the demographics: how short many lives will be.

In the six months of my ongoing battle with brain cancer, one part of financial markets has fascinated me whenever I find time to read.

The Australian housing market is a complex and multifaceted landscape that can be challenging to navigate for beginners.

In Australia, baby boomers, born between 1946 and 1964, are shaping the housing landscape with their unique preferences.

If you’re looking to maximise your superannuation, it’s a good idea to be up to speed on any legal updates that could affect the super and tax landscape.

After another 80% or so plunge from its high in 2021 to its low in 2022, Bitcoin has rebounded again to a new record high.

Cheques and bank service, or the lack of, were major topics when I addressed a seniors’ group recently. The word had got out that the government was phasing out cheques, and many of the members of the audience were feeling abandoned.

It’s an age-old question, is it possible for a person to time the share market? All the data seems to be pointing very firmly to no. It’s simply too hard to do.

Late last year, Phoenix participated in an Investor Day, hosted by listed REIT, Mirvac Group, that focused on ‘Living Sectors’.

Having enjoyed a better than feared consumer-led recovery from COVID lockdowns, Australia’s economy in recent years has quickly been beset by a new problem

The Australian welfare system, including the Age Pension, was designed on the assumption that older people own their home and can age there.

I recently happened upon a practical and often humorous book about how to age successfully.

Over age 60, superannuation benefits paid as either a lump sum or pension are tax free and not assessable for income tax.

The world’s best investor, Warren Buffett, has suffered from the same disease that plagues every other successful fund manager in the world - fading out-performance over time.

Older Australians might be feeling their creaky knees, stiff backs and failing eyesight, but one thing they should not feel is neglected by government departments and agen-cies studying their potential financial futures.

There are valid reasons why economics is called the dismal science, and even the origin of the expression is distasteful.

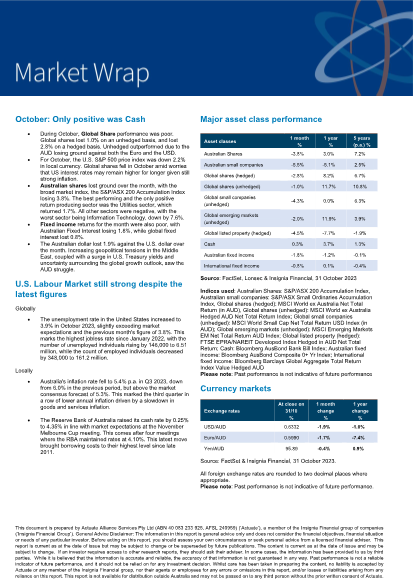

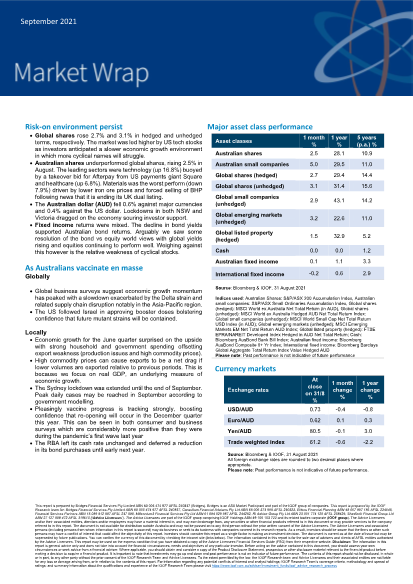

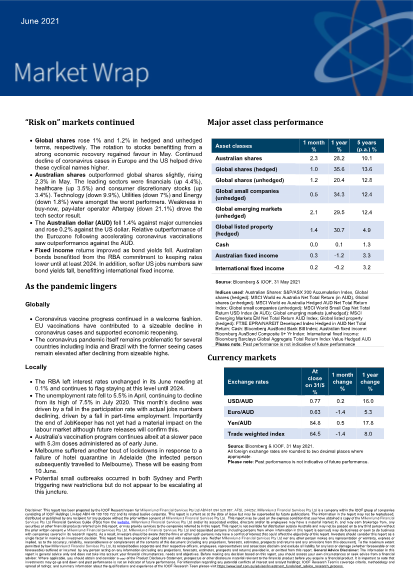

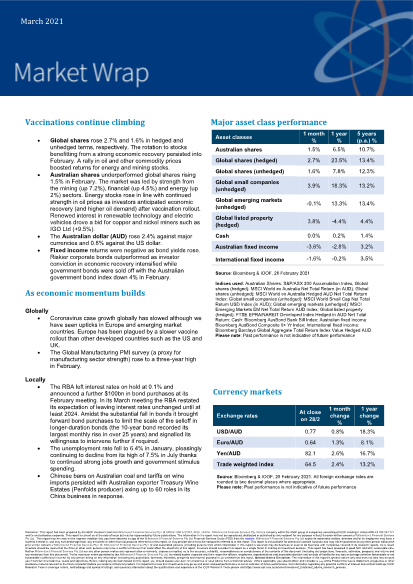

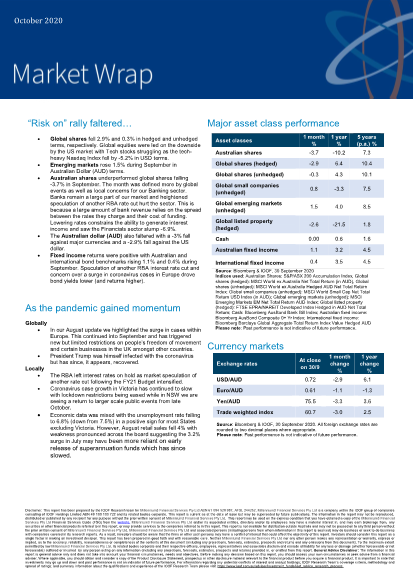

During October, Global Share performance was poor. Global shares lost 1.0% on an unhedged basis, and lost 2.8% on a hedged basis.

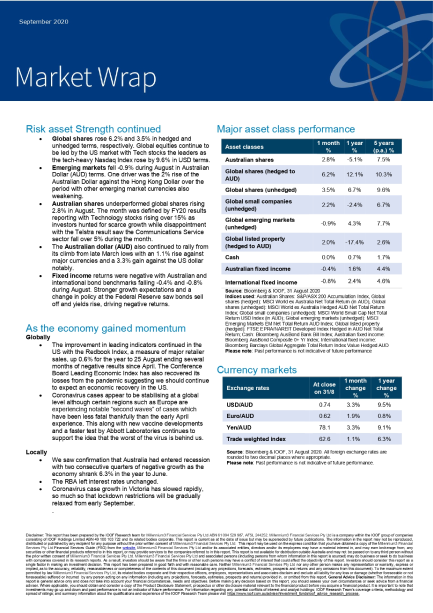

During September, Global Share performance was poor. Global shares lost 4.0% on an unhedged basis, ..

During August, Global Share performance was mixed. Global shares gained 1.6% on an unhedged basis, but lost 2.2% on a hedged basis, due to a depreciating AUD relative to the USD.

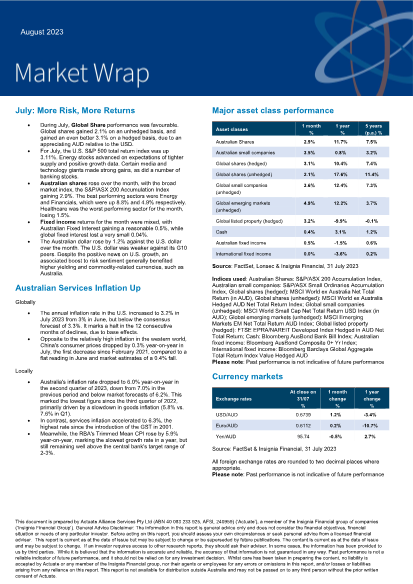

During July, Global Share performance was favourable. Global shares gained 2.1% on an unhedged basis, and gained an even better 3.1% on a hedged basis, due to an appreciating AUD relative to the USD.

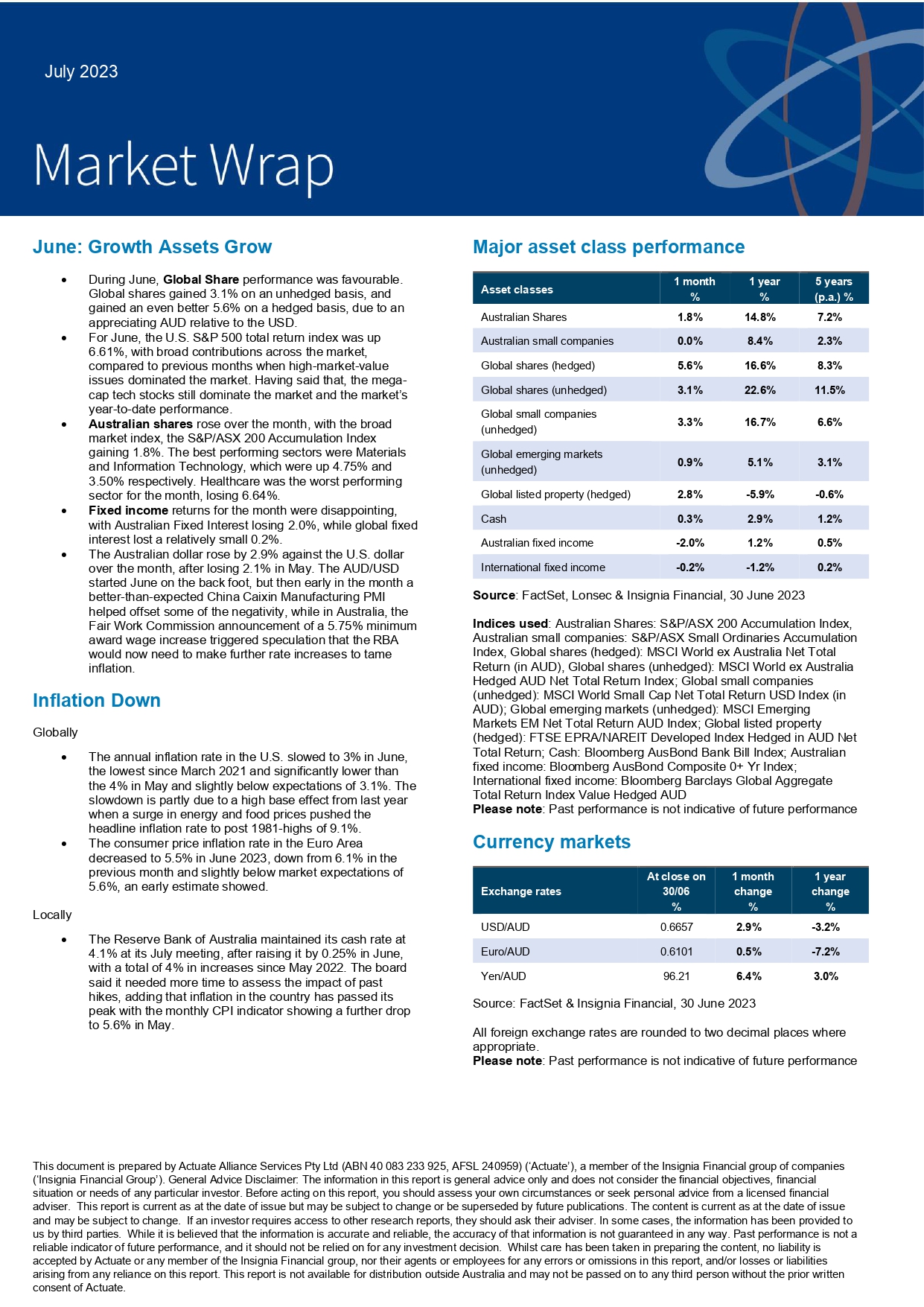

During June, Global Share performance was favourable. Global shares gained 3.1% on an unhedged basis, and gained an even better 5.6% on a hedged basis, due to an appreciating AUD relative to the USD.

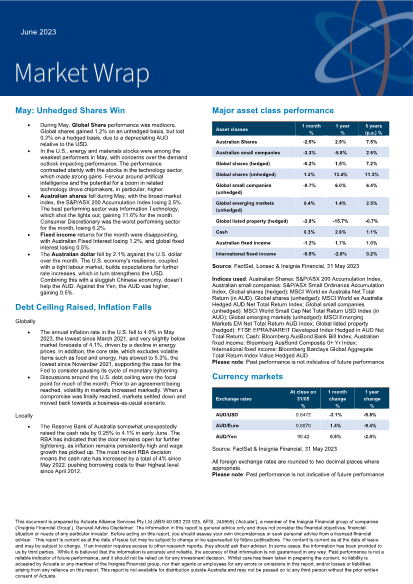

During May, Global Share performance was mediocre. Global shares gained 1.2% on an unhedged basis, but lost 0.2% on a hedged basis, due to a depreciating AUD relative to the USD.

The Government has announced its intention to change the tax concessions for certain super accounts if you have a total super balance of more than $3 million.

If you’re an employee receiving the standard super guarantee (SG) rate, you can look forward to a super boost from 1 July 2023 when the SG rate increases from 10.5% to 11%.

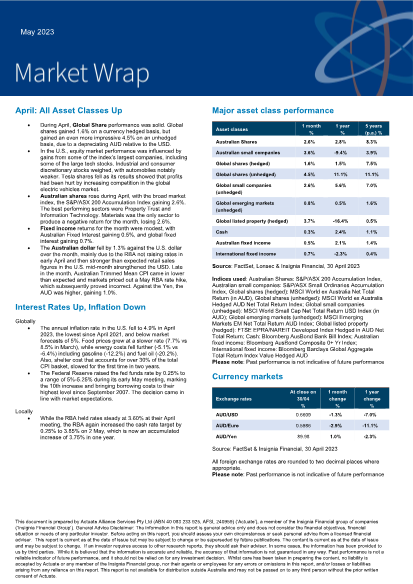

During April, Global Share performance was solid. Global shares gained 1.6% on a currency hedged basis, but gained an even more impressive 4.5% on an unhedged basis, due to a depreciating AUD relative to the USD.

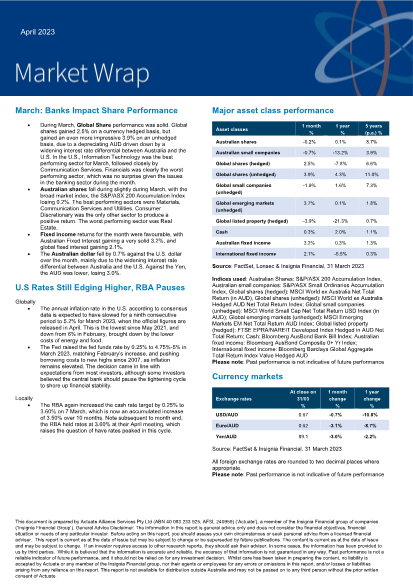

During March, Global Share performance was solid. Global shares gained 2.5% on a currency hedged basis, but gained an even more impressive 3.9% on an unhedged basis, due to a depreciating AUD driven down by a widening interest rate differential between Australia and the U.S. In the U.S., Information Technology was the best performing sector for March, followed closely by Communication Services. Financials was clearly the worst performing sector, which was no surprise given the issues in the banking sector during the month.

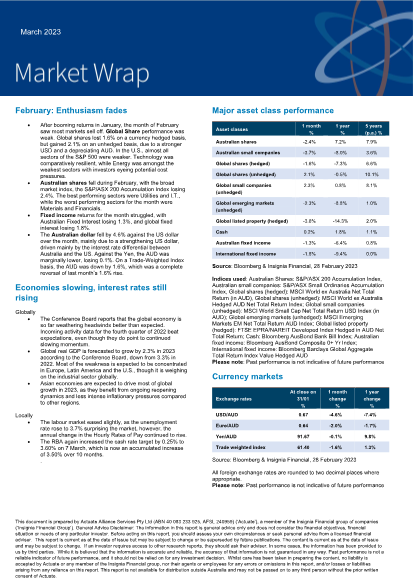

After booming returns in January, the month of February saw most markets sell off. Global Share performance was weak.

Markets started the year on an extremely positive note. Both stocks and bonds producing significantly above average monthly returns.

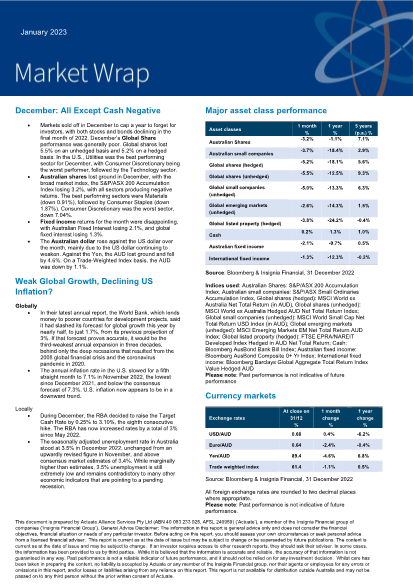

Markets sold off in December to cap a year to forget for investors, with both stocks and bonds declining in the final month of 2022.

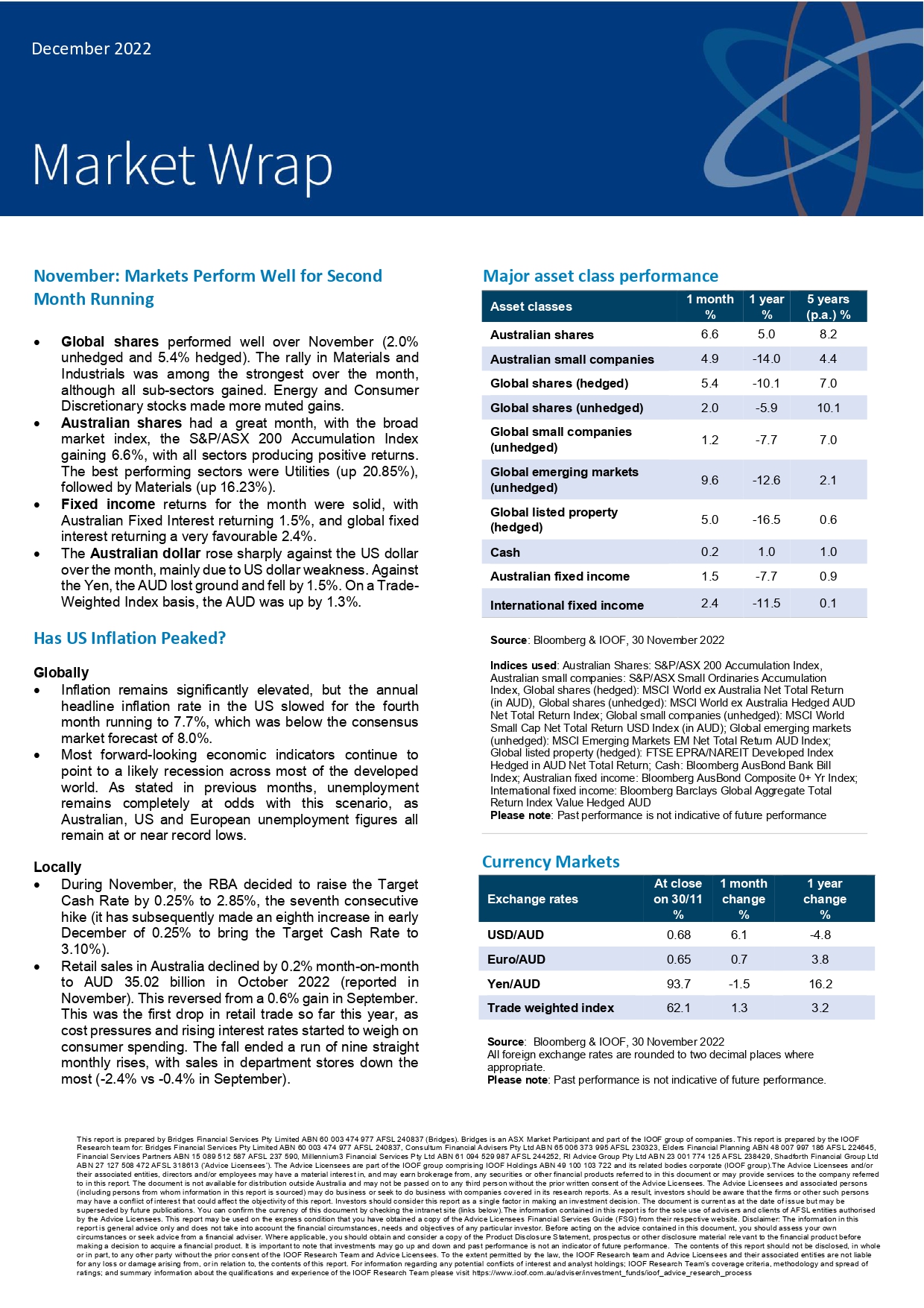

Global shares performed well over November (2.0% unhedged and 5.4% hedged). The rally in Materials and Industrials was among the strongest over the month, although all sub-sectors gained.

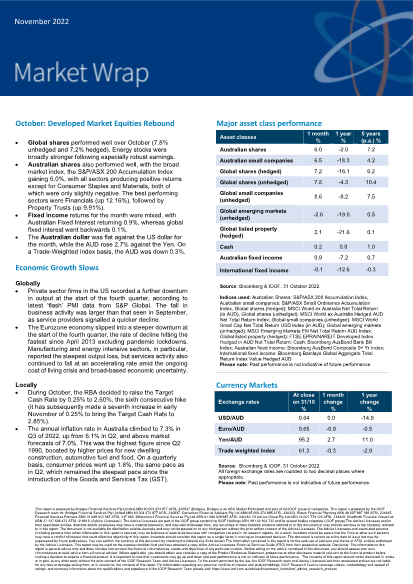

Global shares performed well over October (7.8% unhedged and 7.2% hedged). Energy stocks were broadly stronger following especially robust earnings.

We all like a good cost saving tip, even if it is something we already know. It never hurts to revisit some top tips and take a look at our current situation to see if there are savings to be made.

We spend a lifetime generating wealth but few of us spend the time to ensure it’s passed on in the way we want it to.

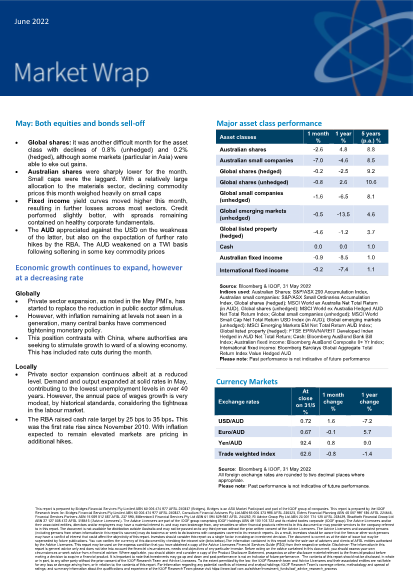

Global shares: it was another difficult month for the asset class with declines of 0.8% (unhedged) and 0.2% (hedged), although some markets (particular in Asia) were able to eke out gains.

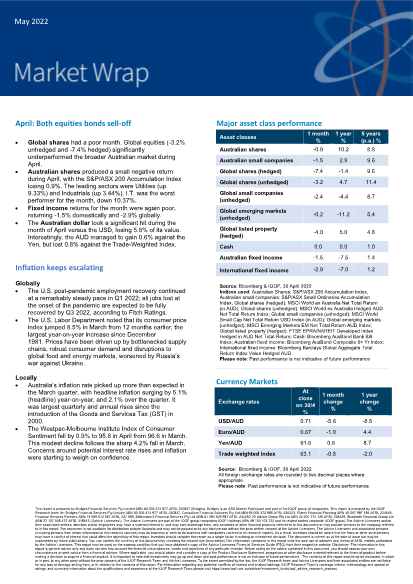

Global shares had a poor month. Global equities (-3.2% unhedged and -7.4% hedged) significantly underperformed the broader Australian market during April.

Planning for a future where super is essential - but only one part of retirement planning – is where financial advice matters. Many people can manage single-focus decisions.

From 1 July 2022, if you’re a first home buyer you can release up to $50,000 (up from $30,000) from your voluntary super contributions to help you buy your first home. Under the scheme, voluntary concessional and non concessional contributions made on or after 1 July 2017 may be released from super to help you purchase your first home.

Imagine if you travelled back 30 years and told your past self how the world would change over the three decades that were to follow.

Nominating your super beneficiary is something you have most likely been asked to do if you have a superannuation fund.

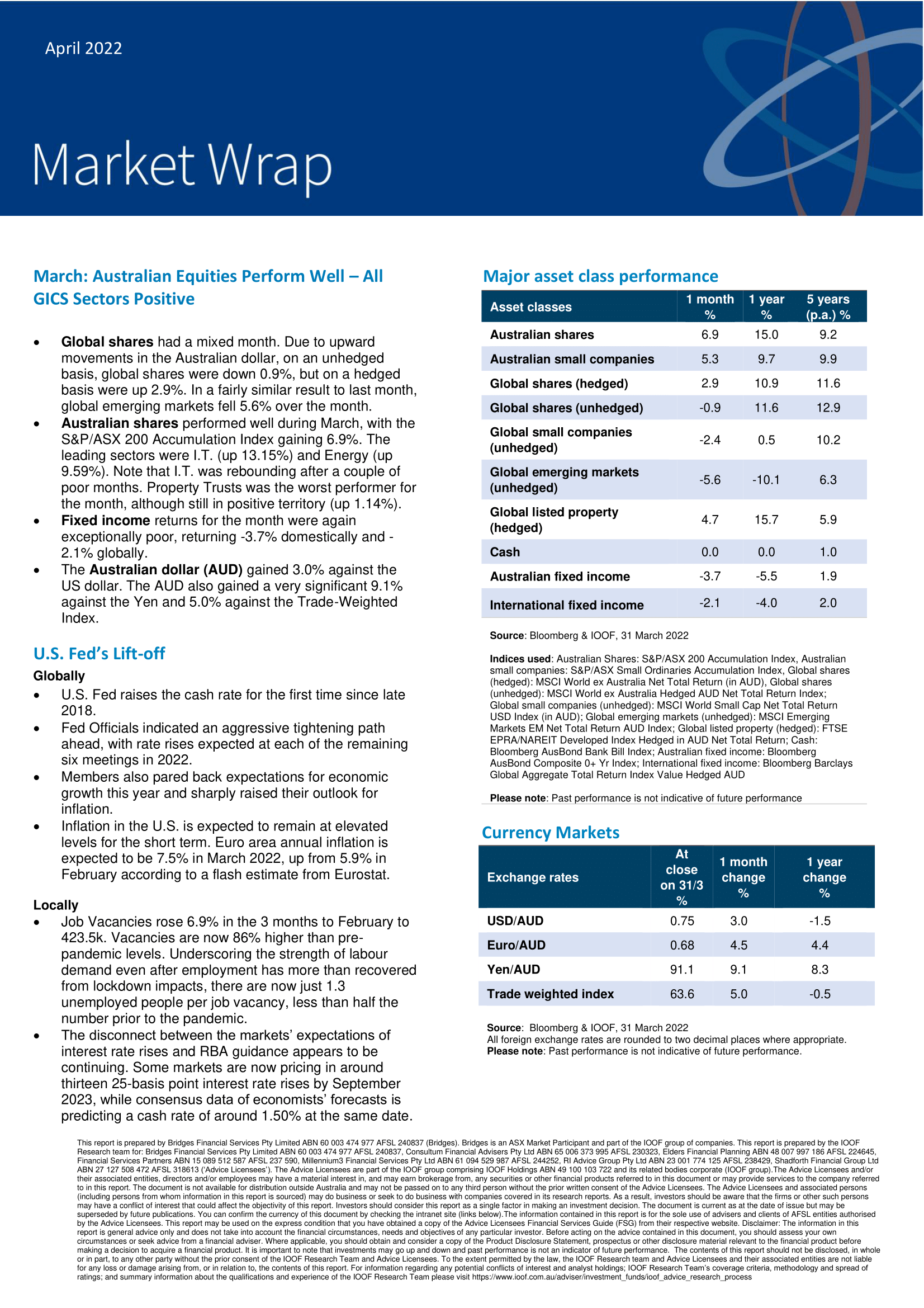

Global shares had a mixed month. Due to upward movements in the Australian dollar, on an unhedged basis, global shares were down 0.9%

The unexpected events of the past few years have made financial protection a front of mind matter for most Australians. Now more than ever we appreciate that life does not always go the way we plan. Having a plan in place if things do take an unexpected turn can mean that our health, lifestyle and family are better protected.

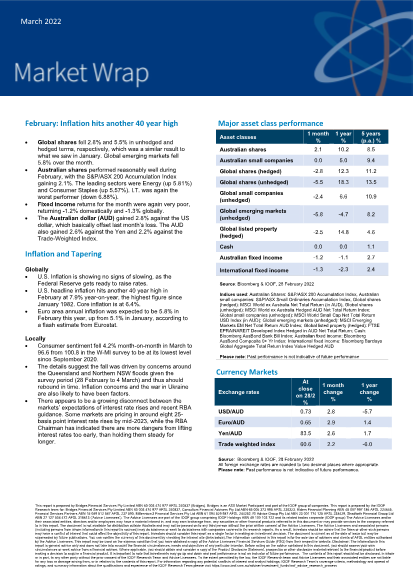

Global shares fell 2.8% and 5.5% in unhedged and hedged terms, respectively, which was a similar result to what we saw in January. Global emerging markets fell 5.8% over the month.

Since July 2018 thousands of people have taken advantage of the Government’s downsizer contribution scheme by selling their home and making contributions to their super.

Are you approaching retirement? Then chances are the funding of your lifestyle in retirement may be on your mind.

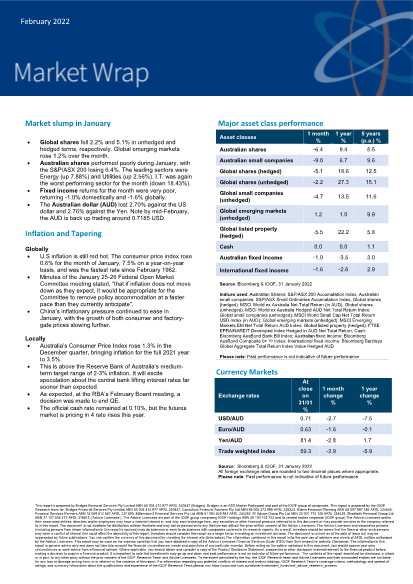

Global shares fell 2.2% and 5.1% in unhedged and hedged terms, respectively. Global emerging markets rose 1.2% over the month.

The last couple of years have been tough on a lot of people with the COVID pandemic throwing the world into chaos and taking a toll on our physical, mental, financial and emotional wellbeing.

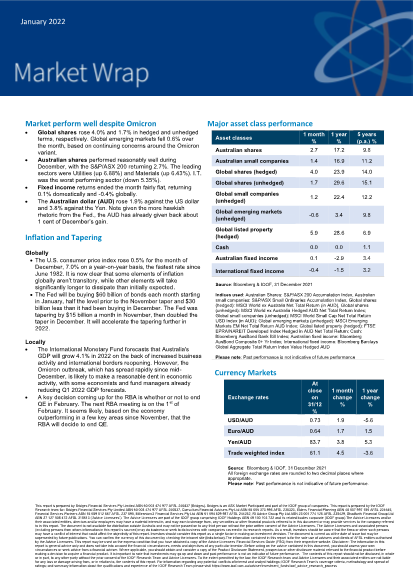

Global shares rose 4.0% and 1.7% in hedged and unhedged terms, respectively. Global emerging markets fell 0.6% over the month, based on continuing concerns around the Omicron variant.

New year is a great time for making lifestyle changes, however, for goals and changes affecting your financial health, there’s often no better time than when starting a new job.

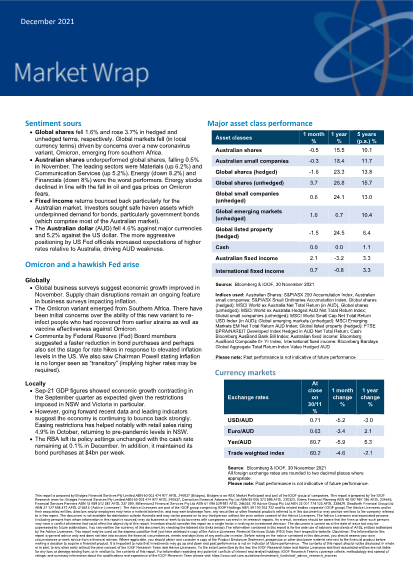

Global shares fell 1.6% and rose 3.7% in hedged and unhedged terms, respectively. Global markets fell (in local currency terms) driven by concerns over a new coronavirus variant, Omicron, emerging from southern Africa.

If you are a small business owner you would know the importance of having a good team behind you.

With a few simple changes, you could set a good example for your children.

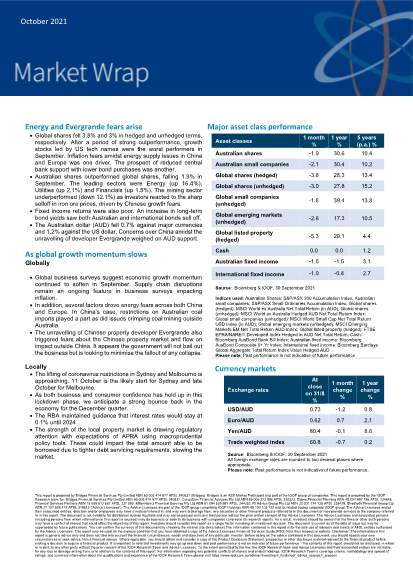

Global shares fell 3.8% and 3% in hedged and unhedged terms, respectively.

Taking care of household finances can be time consuming and boring – and often people don’t know where to start.

That means the longer you live, the more money you will need for your retirement. Whatever your plans, it’s vital you have a strategy in place so that you can build your retirement savings as much as you can before you retire.

On 1 July 2021, a new capital gains tax (CGT) exemption was introduced certain granny flat arrangements, making it easier for older Australians to enter formal granny flat arrangements with the added protection from possible financial abuse if circumstances within the family change.

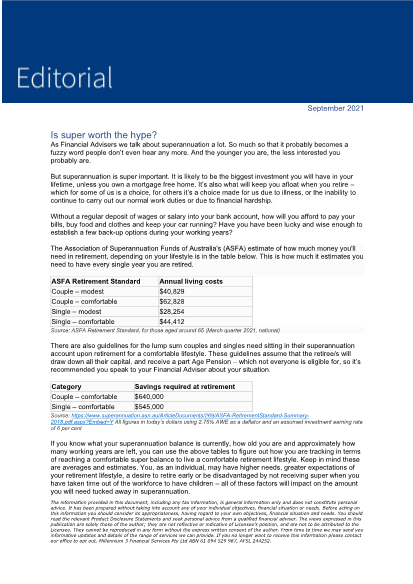

As Financial Advisers we talk about superannuation a lot. So much so that it probably becomes a fuzzy word people don’t even hear any more. And the younger you are, the less interested you probably are.

As Financial Advisers we talk about superannuation a lot. So much so that it probably becomes a fuzzy word people don’t even hear any more. And the younger you are, the less interested you probably are.

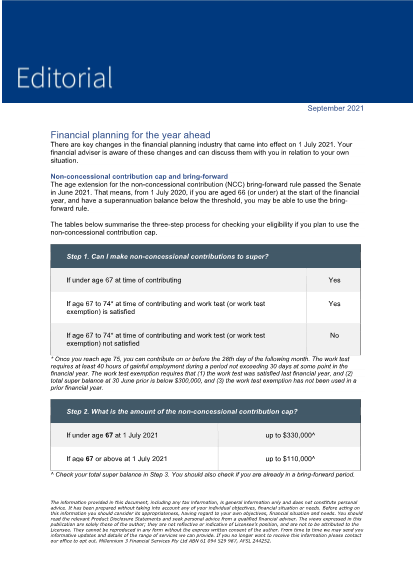

There are key changes in the financial planning industry that came into effect on 1 July 2021. Your financial adviser is aware of these changes and can discuss them with you in relation to your own situation.

It seems we are increasingly using apps in everyday life. Apps can help us manage certain aspects of our lives, tap into things that are of interest to us, or keep track of different goals.

Compared to other investment structures, super is widely considered to be one of the most tax effective investment structures available from a wealth accumulation and cash flow generation perspective. Although not a comprehensive list, below are 11 of the top tax facts about super.

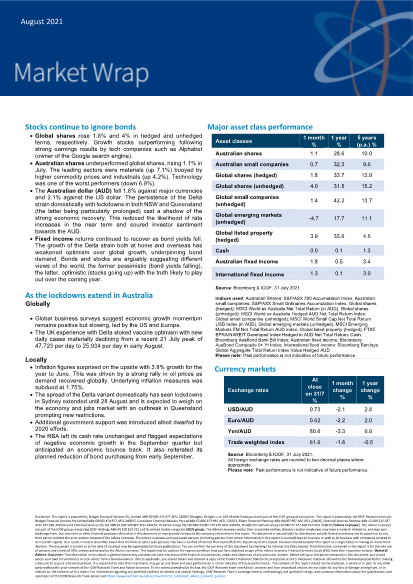

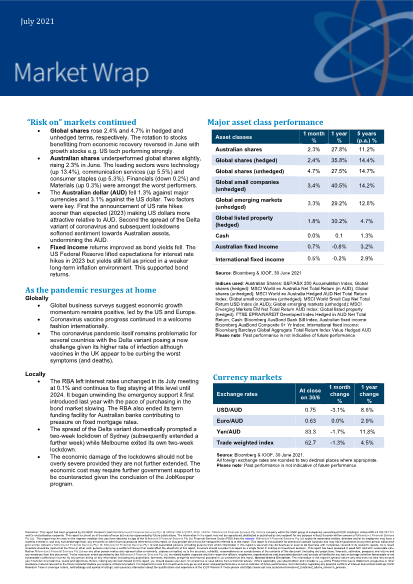

As the lockdowns extend in Australia stocks continue to ignore bonds

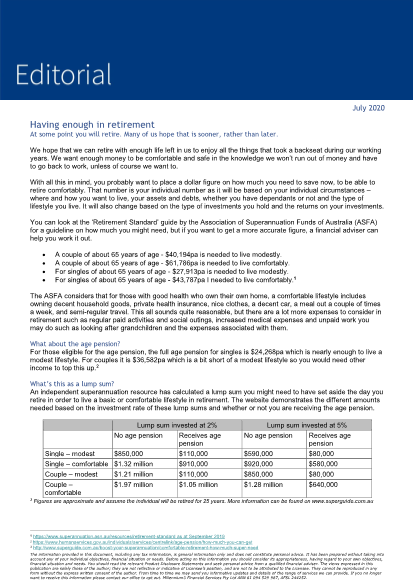

At some point you will retire. Many of us hope that is sooner, rather than later. We hope that we can retire with enough life left in us to enjoy all the things that took a backseat during our working years. We want enough money to be comfortable and safe in the knowledge we won’t run out of money and have to go back to work, unless of course we want to.

When it comes to building and maintaining wealth, super is widely considered to be one of the most tax-effective investment structures available.

If you are in, or nearing, the retirement phase of your lifestyle you might be considering whether you want to stay in your current accommodation, or look for something to suit your needs as they change over the coming years.

In a year that has seen so many unexpected events take place it is top of mind for most Australians now more than ever that life does not always go the way we plan, but having a plan in place if things do take an unexpected turn can mean that our health, lifestyle and family are better protected.

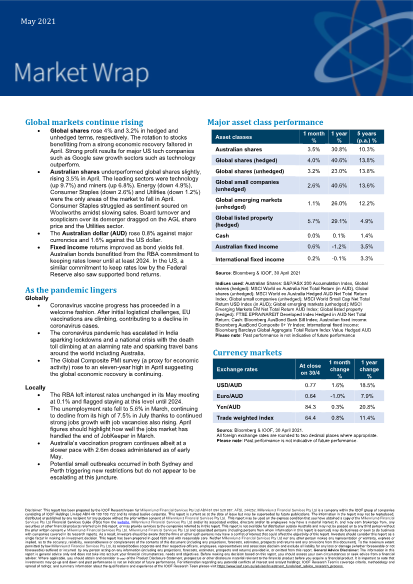

Global shares rose 4% and 3.2% in hedged and unhedged terms, respectively. The rotation to stocks benefitting from a strong economic recovery faltered in April. Strong profit results for major US tech companies such as Google saw growth

Aged care is a complex and emotive topic and many people don’t think about their aged care needs until the time to do something is upon them – at which point the options can be limiting. This article explains a couple of the key areas to consider around your aged care plan.

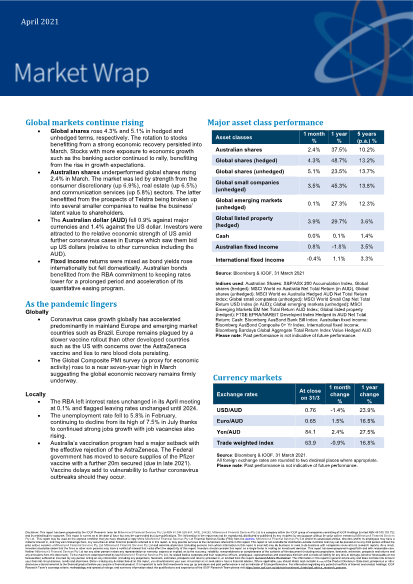

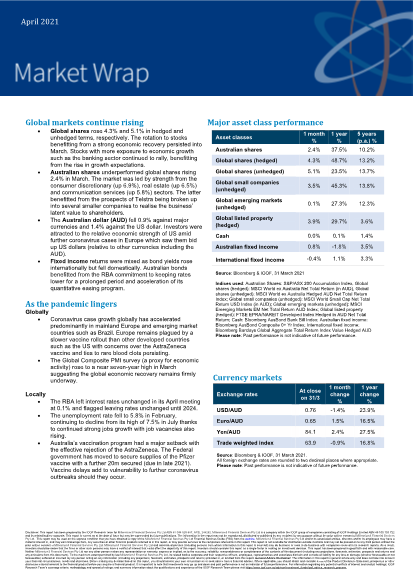

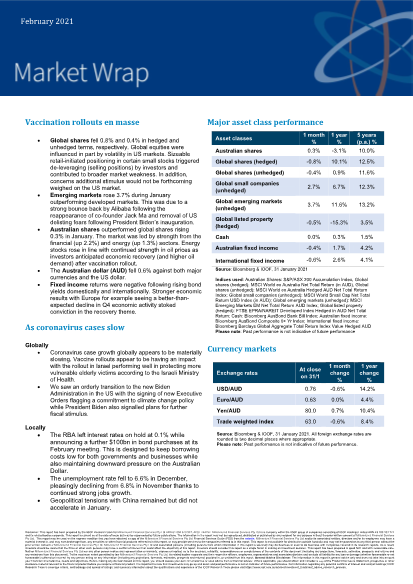

Vaccination rollouts en masse - Global Shares and emerging Markets

Have you made a big financial mistake in the past? One that cost you a lot of time and money to fix?

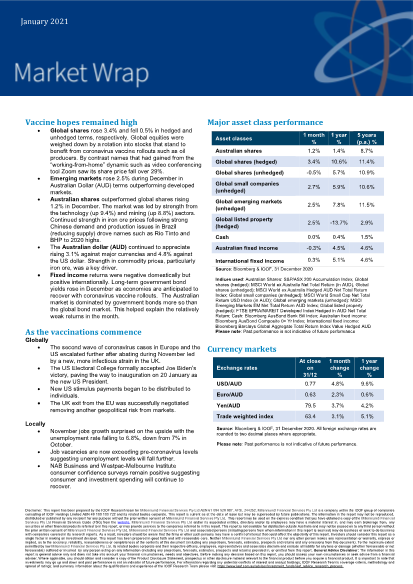

Global shares rose 3.4% and fell 0.5% in hedged and unhedged terms, respectively.

With the increased activity online – be it due to working from home, home schooling, or simply because we have found a great availability of engaging and interesting content and streaming services, we are online a lot more and need to consider if we are adhering to safe cyber practices at home.

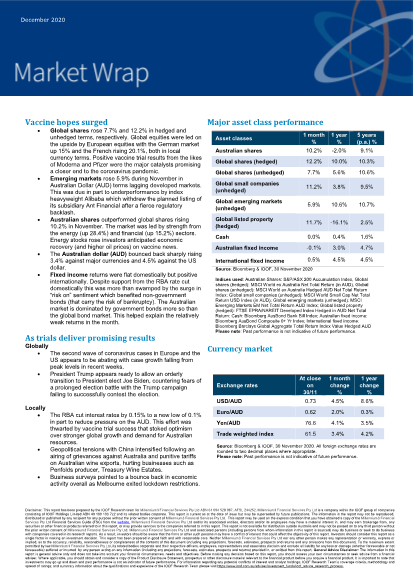

Global shares rose 7.7% and 12.2% in hedged and unhedged terms, respectively.

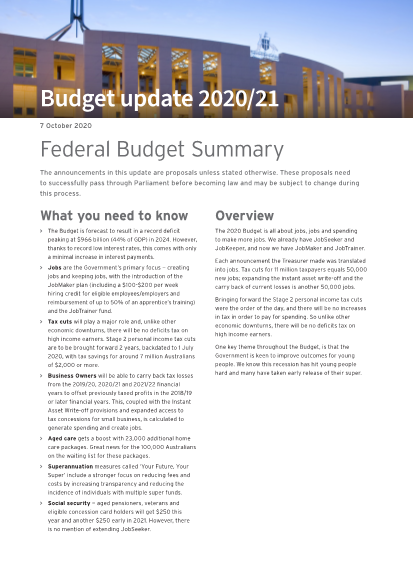

The announcements in this article are proposals unless stated otherwise. These proposals need to successfully pass through Parliament before becoming law and may be subject to change during this process.

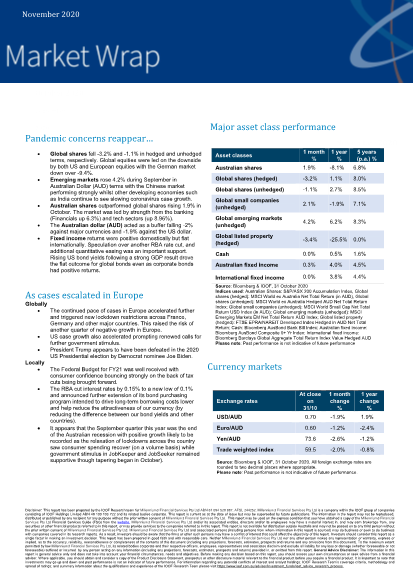

Global shares fell -3.2% and -1.1% in hedged and unhedged terms, respectively.

Having an appropriate financial plan in place covers more than just investments and insurance. The same goes for a financial adviser – there are some you will just click with, who you will feel comfortable opening up to and working with over the long term, to improve your financial future.

Global shares fell 2.9% and 0.3% in hedged and unhedged terms, respectively. Global equities were led on the downside by the US market with Tech stocks struggling as the techheavy Nasdaq Index fell by -5.2% in USD terms.

Federal Budget Summary, The 2020 Budget is all about jobs, jobs and spending to make more jobs.

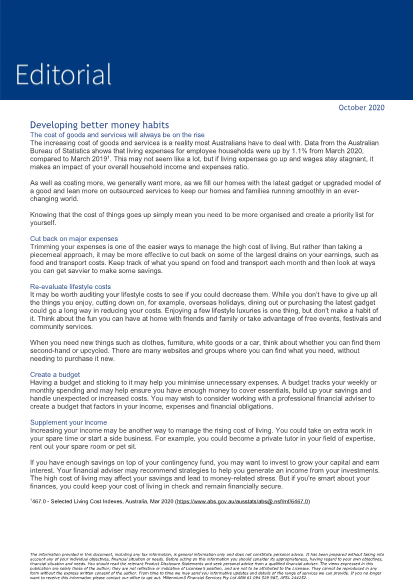

The increasing cost of goods and services is a reality most Australians have to deal with. Data from the Australian Bureau of Statistics shows that living expenses for employee households were up by 1.1% from March 2020, compared to March 20191. This may not seem like a lot, but if living expenses go up and wages stay stagnant, it makes an impact of your overall household income and expenses ratio.

Global shares rose 6.2% and 3.5% in hedged and unhedged terms, respectively. Global equities continue to be led by the US market with Tech stocks the leaders as the tech-heavy Nasdaq Index rose by 9.6% in USD terms.

If you are not ready to take your foot completely off the break as your working career slows down, you may find a happy medium and foster a healthy routine by working in retirement.

Research shows that parents’ actions affect their children’s behaviour and the effects can last into adulthood.1 This puts the onus on parents to help their children develop the skills and behaviours to make smart financial decisions – from learning about the importance of saving to the power of compounding interest.

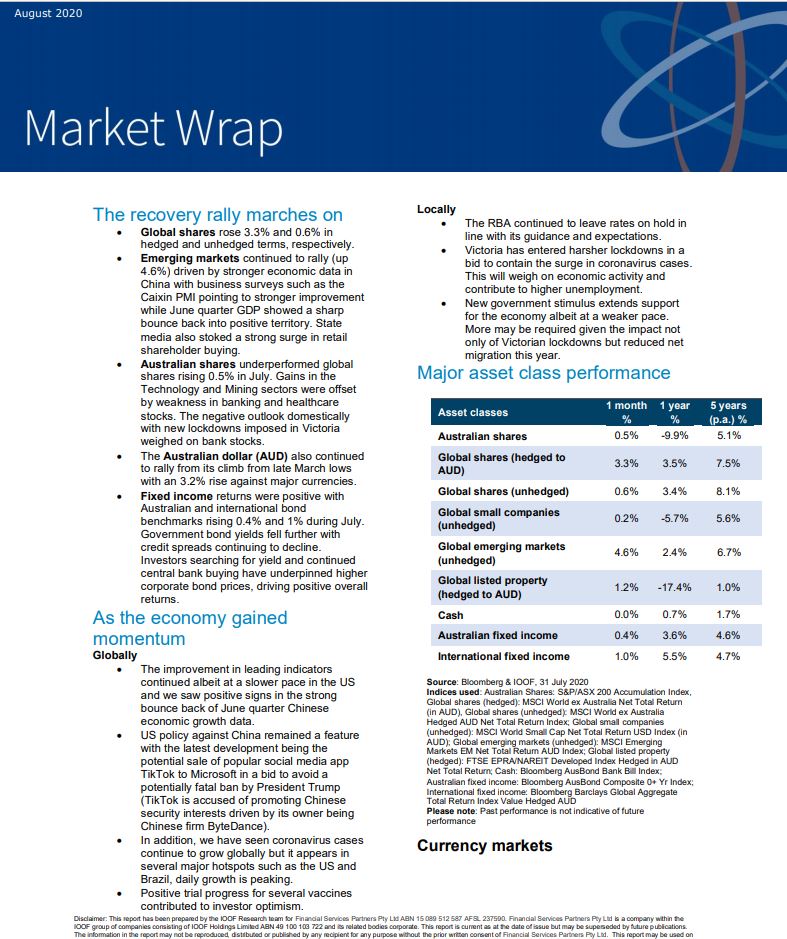

Global shares rose 3.3% and 0.6% in hedged and unhedged terms, respectively.

If you are worried about the rising cost of living expenses and are not seeing any wage increases, then it’s time to get organised with your finances, set a realistic budget, work out what you can do without and where you can invest to save.

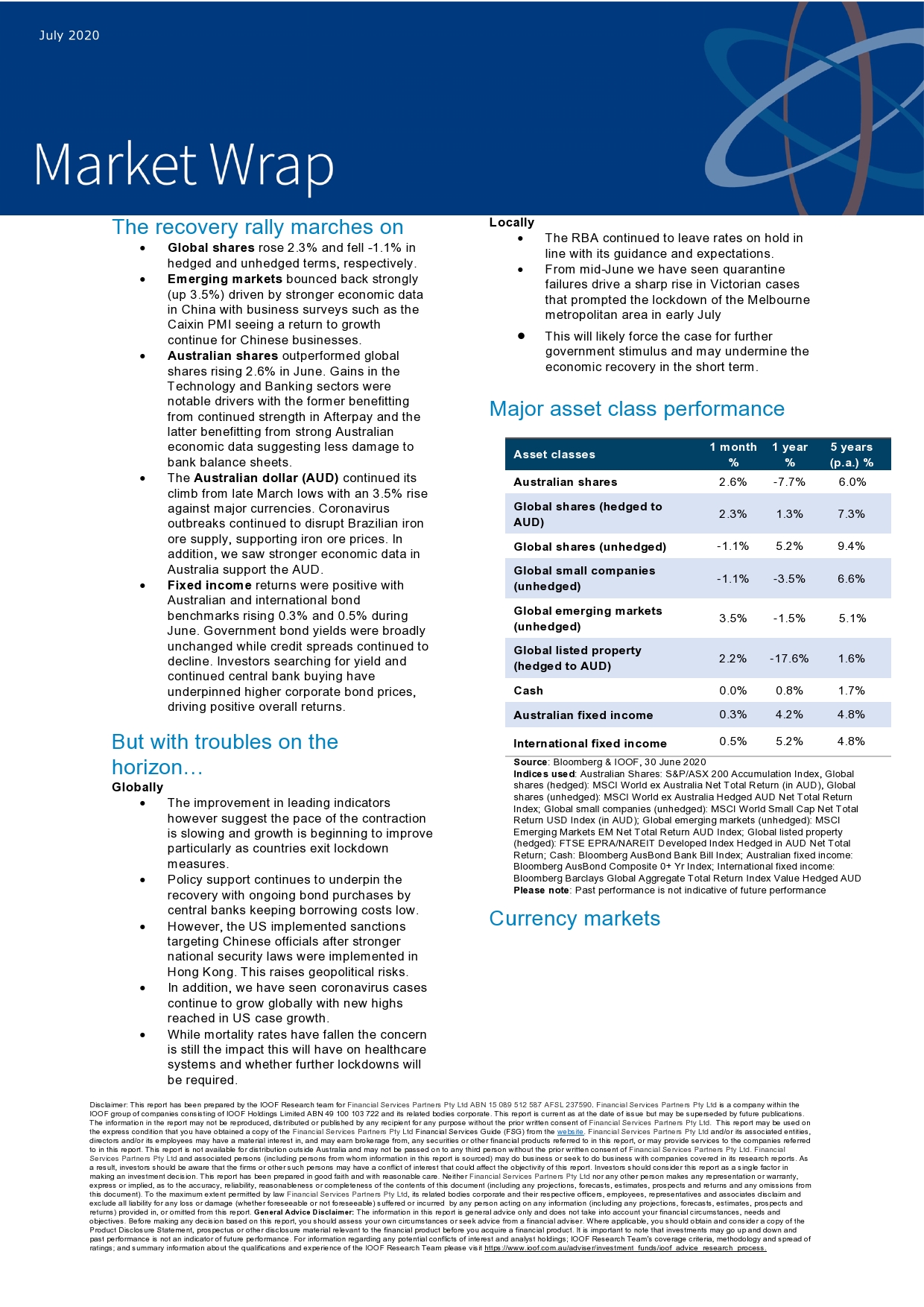

Global shares rose 2.3% and fell -1.1% in hedged and unhedged terms, respectively.

We hope that we can retire with enough life left in us to enjoy all the things that took a backseat during our working years. We want enough money to be comfortable and safe in the knowledge we won’t run out of money and have to go back to work, unless of course we want to.